Starting a company in France comes with its costs. We will look into the different expenses you’ll face. This includes everything from registration fees to legal costs.

Understanding Company Setup Prices in France

Setting up a company in France involves knowing the costs. These costs depend on the company type, location, and extra services needed. Understanding these helps make better choices during setup.

Factors Influencing the Costs

Many things affect the costs of setting up a company. The type of company you choose can change the costs a lot. For example, a SARL and an SAS have different start-up costs.

The location also matters a lot. Different areas in France have different fees and taxes for businesses. You also need to think about admin costs, legal fees, and the cost of professional services needed.

Types of Companies in France

France offers many company types, each for different business needs. The most common are:

- Société à Responsabilité Limitée (SARL)

- Société par Actions Simplifiée (SAS)

- Société Anonyme (SA)

- Société en Nom Collectif (SNC)

Each type has its own rules, costs, and duties. This lets entrepreneurs pick the best setup for their goals.

Company Formation Fees: An Overview

Knowing about company formation fees is key for starting a business in France. These costs change based on the company type and the services needed. Let’s look at the main expenses to understand what’s involved.

Registration Expenses

Registration costs in France are between €50 and €250. They depend on the company type and the registration process. This step makes our business legal and operational. Knowing these costs helps us plan our budget better.

Notary Fees

Some companies face notary fees in France, ranging from €300 to €800. These fees add to the overall costs. Notaries ensure our documents meet legal standards, adding authenticity to our business.

| Type of Expense | Cost Range (€) |

|---|---|

| Registration Expenses | 50 – 250 |

| Notary Fees | 300 – 800 |

Legal Costs in Company Formation

Knowing the legal costs for setting up a company in France is key. A big part of these costs is hiring legal advisors. They help us understand French business law and avoid problems.

Hiring Legal Advisors

The cost of hiring legal advisors in France can range from €500 to €2,000. This is a big investment for getting the right help during the setup. Legal advisors help with the business structure, compliance, and tax advice. Their knowledge helps avoid major issues.

Drafting Incorporation Documents

Creating the right incorporation documents is also vital. These documents outline the business’s legal structure and how it will operate. Good documents help follow French law and make dealing with authorities easier. Quality legal support leads to better documents and a stronger business start.

Accounting and Taxation Fees

Starting a business in France means we must think about accounting and tax costs. These costs are important for following local rules and keeping our finances healthy. The first costs can be high, from €300 to €1,500, based on our business type and needs.

Initial Accounting Setup Costs

It’s key to set up good accounting from the start. Costs include hiring experts for financial planning and setting up systems and software. We need to budget well to build a strong accounting base for growth and tax needs.

Ongoing Tax Obligations

Our business in France will have ongoing tax duties. These include corporate taxes, which depend on profits and company type. It’s wise to talk to tax experts to understand our duties and stay in line with French tax laws.

Government Fees and Charges

Starting a company in France means we need to know about government fees. These costs are key to planning our budget. The fees for setting up and filing annually are big parts of our expenses.

Company Registration Fees

The cost to register a company is usually around €60. This is the first step to making our business official. The exact fee can change based on the company type, like a limited liability company.

Annual Filing Costs

The cost to file annually in France can change a lot. It depends on our company’s type and how much money it makes. Costs can be from €200 to over €1,000 a year. Our business’s complexity and the services we choose also play a role.

| Fee Type | Estimated Cost |

|---|---|

| Company Registration Fee | €60 |

| Annual Filing Costs (low estimate) | €200 |

| Annual Filing Costs (high estimate) | €1,000+ |

Choosing the Right Company Structure

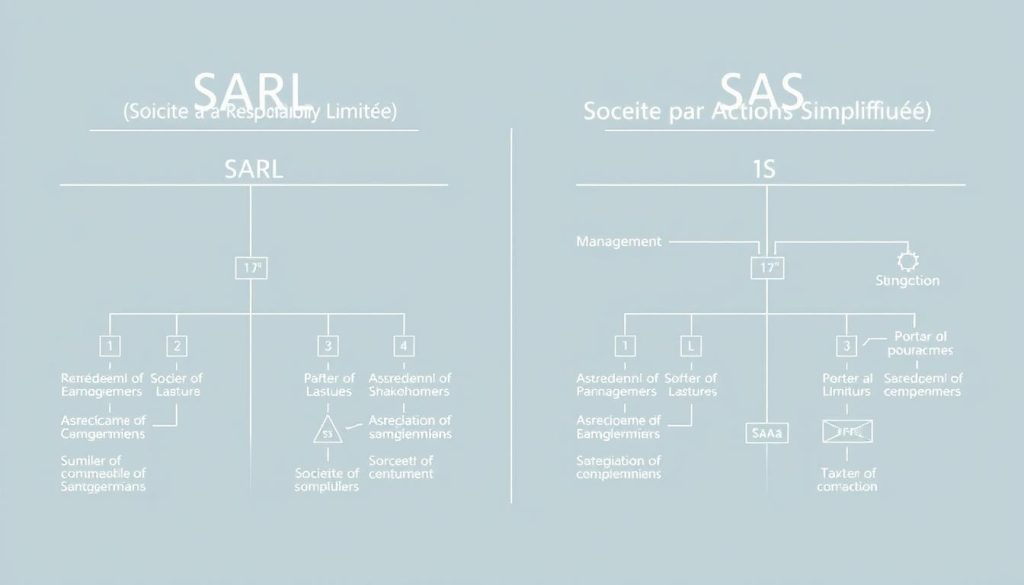

Choosing the right company structure is key for starting a business in France. You have two main options: Societe a Responsabilite Limitee (SARL) and Societe par Actions Simplifiee (SAS). Each has its own benefits and drawbacks, affecting how your company operates and its start-up costs.

Societe a Responsabilite Limitee (SARL)

The SARL is great for small to medium-sized businesses needing a simple management setup. It only needs €1 in capital, making it easy to start. Shareholders also get protection from business debts, keeping their personal assets safe.

- Advantages:

- Simple structure for small businesses.

- Low minimum capital needed.

- Shareholders’ personal assets are safe.

- Disadvantages:

- Share transfers can be tricky.

- There are limits on the number of shareholders.

Societe par Actions Simplifiee (SAS)

The SAS is more flexible, making it good for startups and bigger companies. It costs more to start than a SARL but is better for raising capital and managing the company.

- Advantages:

- Flexible and adaptable structure.

- Easy to transfer shares, attracting investors.

- No limit on the number of shareholders.

- Disadvantages:

- More expensive to set up.

- Can have more complex management rules.

When picking between SARL and SAS in France, think about flexibility, liability, and start-up costs. This will help you choose the best structure for your business goals.

Additional Expenses to Consider

Starting a company in France means looking at more than just registration and legal fees. We also need to think about business insurance and office space costs.

Business Insurance Costs

Business insurance is a must. It guards us against risks that come with running a company. The cost can vary a lot, from €300 to €2,000 a year. This depends on our business type, the coverage we choose, and our industry’s risks.

Office Space and Utilities

Finding the right office space can be expensive. In places like Paris, the prices can be very high. We must plan for these costs, as they affect our budget a lot. We also need to remember to include expenses like electricity and internet in our budget. This helps us understand the total cost of keeping a workspace running.

The Importance of Professional Support

Getting help from professionals when setting up a company can make things easier and ensure you follow the law in France. Starting a business in another country can be tough, even for UK entrepreneurs. With the help of experts in tax, law, and finance, we can tackle challenges and find new chances.

Benefits of Consulting Experts

Getting advice from experts in France has many benefits for setting up a company:

- Local Knowledge: People with experience in the French market know the legal, financial, and cultural details of starting a business.

- Reduced Risk: Getting advice tailored to your needs helps avoid breaking the law, which could cost a lot or slow you down.

- Efficiency: Professional help can make things like registration, paperwork, and tax easier, so you can focus on your business.

- Networking Opportunities: Working with local experts can help you meet people in the business world, which can help your business grow.

Recommended Professionals in France

When looking for help to set up a company, it’s key to find trusted firms. Here’s a list of recommended professionals and their areas of expertise to help UK entrepreneurs:

| Professional/ Firm | Specialization | Contact Method |

|---|---|---|

| Fiducial | Accounting and Taxation | Website |

| Gide Loyrette Nouel | Legal Advice | Phone |

| In Extenso | Business Consulting | |

| Cabinet Soregor | Financial Consulting | In-Person |

Hidden Costs of Company Setup

Setting up a company in France can lead to unexpected costs. These can greatly affect our budget. It’s important to watch out for these hidden costs.

They might include extra legal fees or unexpected fees from local authorities. These can make our financial planning more complex.

Potential Unexpected Fees

Several hidden costs can pop up during setup. These might include:

- Extra costs for specialised legal advice.

- Localized compliance fees that differ from initial estimates.

- Additional registration fees related to specific business sectors.

- Unexpected costs for permits and licenses.

Knowing about these costs is key to a good financial plan. It helps us establish a strong presence in France.

Currency Fluctuation Considerations

Currency risks add another layer of complexity. As UK entrepreneurs, we often convert GBP to EUR for expenses. Sudden changes in exchange rates can increase costs.

Understanding these changes helps us manage our company’s cash flow better. It reduces financial risks.

Comparison to UK Company Setup Prices

Looking at the UK vs France company setup costs, we see big differences. These differences are key for anyone planning to start a business in either country. The initial costs vary, but ongoing compliance costs also matter a lot.

Key Differences in Cost Structures

The main difference is in the registration fees. In the UK, setting up a limited company costs less than in France. France has more fees during the setup process.

| Cost Category | UK Costs (£) | France Costs (€) |

|---|---|---|

| Company Registration Fee | £12 – £100 | €50 – €250 |

| Legal Fees | £200 – £500 | €400 – €1500 |

| Accountancy Fees | £500 – £1500 | €700 – €2000 |

Similarities in Registration Processes

Even with different costs, the UK and France share similarities in setting up a company. Both need important documents like proof of identity and a business address. Knowing these similarities can help UK entrepreneurs when starting a business in France.

Financing Your Company Setup

Starting a new business often needs a lot of money. We can look at different ways to get funding for entrepreneurs in France. Knowing how to finance your company can help with the initial costs.

Available Grants and Subsidies

The French government has many grants and subsidies for new businesses and foreign investors. These funds can help lower startup costs. It’s important to check out specific programs, as they might have certain rules.

These programs can help with things like buying equipment or covering operational costs.

Loans for New Businesses

Getting loans for startups is another good option. Many banks in France offer special loans for new businesses. These loans might have better terms, like lower interest rates and longer to pay back.

Having a solid business plan is key when applying for a loan. It shows that your business could be successful.

Taxation Considerations Post-Setup

It’s important to know about taxes in France after setting up a business. We must look at corporate tax and VAT. These affect our costs and how we price our products. Knowing about these taxes helps us stay competitive and follow the rules.

Corporate Tax Rates in France

The corporate tax in France changes with profit levels. In 2023, the main rate is 25%. But, smaller businesses might pay less. Here’s a quick guide to the tax rates:

| Profit Range (€) | Tax Rate (%) |

|---|---|

| 0 – 38,120 | 15 |

| 38,121 – 500,000 | 25 |

| Over 500,000 | 26.5 |

Value Added Tax (VAT) Implications

VAT in France is key for our pricing. The standard rate is 20%. But, some items and services have lower rates of 5.5% and 10%. Knowing these rates helps us set prices right and keep costs down. Here’s a look at the VAT rates:

| VAT Category | VAT Rate (%) |

|---|---|

| Standard Rate | 20 |

| Reduced Rate 1 (e.g., food, books) | 5.5 |

| Reduced Rate 2 (e.g., some restaurant services) | 10 |

It’s critical to understand these taxes when planning our finances. This helps us set a realistic budget for our business in France.

Navigating the French Regulatory Environment

The French regulatory environment can be challenging for businesses. It’s key to understand the costs of compliance to follow local laws. This means knowing the legal expenses and taking steps to stay in line with regulations.

Compliance Costs

Compliance costs can differ a lot based on the business type and industry. Important factors include:

- Licensing and permit fees

- Accountancy and legal advisory costs

- Regular audits and inspections

- Training and development for staff on compliance issues

Knowing these costs helps us plan better and stay compliant with French rules.

Understanding Local Laws

Knowing local business laws is vital for success in France. Laws cover many areas, such as:

- Employment law, including worker rights and employer obligations

- Environmental regulations affecting manufacturing and waste disposal

- Health and safety rules applicable to workplaces

Each area needs our focus to follow laws and protect our investments. By being informed and proactive, we can succeed in France.

Tips for Budgeting Your Company Setup

Effective budgeting is key for starting a business. It helps us use resources wisely and keep control of our finances. A detailed business plan and a contingency fund can protect us from unexpected costs.

Preparing a Detailed Business Plan

A good business plan is the foundation of success. It outlines our goals, target market, and financial plans. This plan is our roadmap and helps us get funding.

- Executive Summary

- Market Analysis

- Marketing Strategy

- Financial Projections

Creating a solid plan boosts our financial stability and investor trust.

Setting Contingency Funds

Having a contingency fund is essential. Unexpected costs can pop up, and we need a safety net. Experts suggest saving 10-20% of our budget for these surprises.

- Additional legal fees

- Operational delays

- Unexpected repairs or maintenance

Contingency funds help us handle surprises without losing focus on our goals.

| Budget Item | Estimated Cost | Contingency Fund (15%) |

|---|---|---|

| Company Registration Fees | £150 | £22.50 |

| Legal Costs | £600 | £90 |

| Equipment Purchase | £1200 | £180 |

| Marketing and Advertising | £300 | £45 |

| Total | £2250 | £337.50 |

By following these budgeting tips, we can manage our resources better. This approach reduces risks and sets us up for success.

Conclusion: Making Informed Decisions

As we conclude our look at company setup costs in France, it’s clear that knowing the details is key for UK entrepreneurs. Understanding the rules and fees helps us plan better. This knowledge helps us make smart choices that could lead to great rewards.

Final Thoughts on Company Setup Costs

In this article, we’ve looked at what affects company setup costs. We’ve seen how important getting professional help and planning is. The costs may seem high at first, but they’re vital for following the law and growing your business.

Our findings show that being well-prepared can bring big benefits in the French market.

Exploring Future Growth Opportunities

Looking ahead, France offers many chances for growth. With a solid business plan and a willingness to adapt, we can grow. Staying connected with local networks and keeping up with trends will help us make the most of our investment.

Let’s start this journey with the knowledge of what’s needed and the excitement for what’s possible.